VIETNAM’S LEADING FOR-RENT

INDUSTRIAL DEVELOPER

Q3 2021BW BREAKING NEWS

BW won the prestigious annual BCI Asia Awards Top 10 Developers 2021, which honors leaders in architecture and development in Vietnam.

Previously, BW was named “Best Industrial Developer” in Vietnam Investment Bridge Magazine’s Outstanding Property Awards for both 2019 & 2020.

We are very proud to announce the launch of BW’s new website.

Investors can now find information about how to invest in Vietnam - everything from the general investment climate, to understanding Vietnam’s industrial property landscape and finding the right location that fits your business requirements.

In addition, existing businesses can now market themselves with our supplier listing tool.

BW ONLINE EVENTS

MTD TV Logistics Investment Forum 2021

Date: Wednesday 30 June 2021

Time: 10:00 AM - 11:00 AM HKT

In this exclusive interview with Dongwon Kwak, BW’s Vice President & Head of North, he will discuss the factors that are driving demand for industrial space in the region as well as his predictions for the market post pandemic.

MTD TV Logistics Investment Forum 2021

Date: Tuesday 6 July 2021

Time: 10:00 AM - 11:00 AM HKT

Real estate portfolios in Asia’s core logistics markets are now yielding dependable cash flows for institutional investors while also creating opportunities for core funds and listed REITs. Watch the show with insightful sharing from Lance Li, CEO of Vietnam BW Industrial Development JSC who has more than 20 years of experience in logistic projects in Greater China, Southeast Asia and other markets in the region.

MTD TV Logistics Investment Forum 2021

Date: Tuesday 13 July 2021

Time: 10:00 AM - 11:00 AM HKT

E-commerce is growing at breakneck rates in Asia’s developing markets and the rise of online shopping is helping to drive opportunities for logistics developers and investors who are launching new projects. This second panel in the logistics forum will cover opportunities in developing markets such Vietnam, India and other fast-growing locations.

SITE AVAILABILITY

(Latest update as of July 10, 2021. Please check with your favorite sales representative before confirming with your client.)

READY-BUILT FACTORY

SOUTH

| Location | Project | Construction completion |

Available GLA (sqm) |

|

|---|---|---|---|---|

| Binh Duong | Bau Bang | Pre-phase & Phase 1, 2 | 06/2019 | 4,500 |

| Phase 3 - 7 | 04/2020 | 11,209 | ||

| Bau Bang Extension | Phase 1 | 10/2022 (tentative) |

89,924 | |

| Phase 2 | 10/2022 (tentative) |

355,124 | ||

| My Phuoc 3 | Phase 1, 2, 3 | 12/2019 | - | |

| Phase 4, 5, 6 | 05/2020 | - | ||

| My Phuoc 4 | Phase 1 | 08/2021 | 69,572 | |

| Dong Nai | Nhon Trach 2 - Loc Khang | Phase 1 | 07/2022 (tentative) |

159,062 |

| Dau Giay | Phase 1 | 08/2022 (tentative) |

78,000 | |

| Nhon Trach 1 | Phase 1 | 10/2022 (tentative) |

75,550 |

NORTH

| Location | Project | Construction completion |

Available GLA (sqm) |

|

|---|---|---|---|---|

| Bac Ninh | VSIP Bac Ninh | Phase 1 | 07/2019 | 1,537 |

| Hai Duong | VSIP Hai Duong | Phase 1 | 04/2020 | 714 |

| Phase 2 | 07/2021 | 85,013 | ||

| Phase 3 | 07/2022 (tentative) |

108,216 | ||

| Hai Phong | VSIP Hai Phong | Phase 1 | 04/2020 | 10,355 |

| Phase 2 | 05/2021 | 16,308 | ||

| Phase 3 | 03/2023 | 48,463 | ||

| Nam Dinh Vu | Phase 1 | 01/2022 (tentative) |

62,136 |

SOUTH

| Location | Project | Construction completion |

Available GLA (sqm) |

|

|---|---|---|---|---|

| Binh Duong | VSIP 2A | Plot 1 | 05/2021 | - |

| My Phuoc 4 | Plot 1 | 08/2021 | 159,052 | |

| Tan Dong Hiep B | Plot 1 | Q2/2022 (tentative) |

52,678 | |

| Dong Nai | Nhon Trach 2 - Loc Khang | Plot 1 | 02/2022 (tentative) |

89,028 |

| HCMC | Tan Phu Trung | Plot 1 | 03/2020 | - |

| Plot 3 | 04/2021 | 76,737 | ||

| Plot 4 | 07/2021 | - |

NORTH

| Location | Project | Construction completion |

Available GLA (sqm) |

|

|---|---|---|---|---|

| Hai Phong | Deep C | Plot 1 | 07/2021 | 30,687 |

| Plot 2 | Q1/2022 (tentative) |

54,801 |

| Standard fitout | |

|---|---|

| GLA (sqm.) | Minimum 500 sqm. We also offer built-to-suit for requirement 10,000+ sqm. |

| Lease term (year) | Minimum 3 years - 10 years |

| Security deposit | 06 months of gross rent |

INDUSTRY HIGHLIGHTS

(Follow link to read full articles)

VIETNAM’S BUSINESS ENVIRONMENT

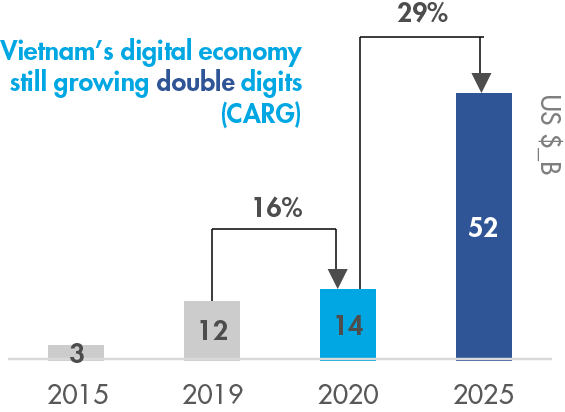

Vietnam’s digital economy is forecast to grow to USD52bn by 2025 - an annual 29% increase from 2020 - according to a study by Alphabet Inc.’s Google, Temasek Holdings Pte and Bain & Co.

Startups backed by Warburg Pincus LLC and JD.com Inc., regional players - including Singapore’s Sea Ltd.’s Shopee - and even Amazon.com Inc. are also targeting the country’s growing middle class.

Naver Group has teamed with the Hanoi University of Science and Technology - one of the country's top institutions - to launch Vietnam’s first AI research center in the capital city, Japan-based Nikkei has reported.

Naver's deal with Vietnam signals the next wave of South Korean investment in Vietnam that is focusing on AI.

Vietnam is the only country in the world that has been upgraded to positive by all three credit rating organizations - Moody's, S&P and Fitch.

The relative strength of Vietnam's performance was largely due to its success in bringing the coronavirus outbreak swiftly under control - despite the pandemic's impact on domestic economic activity and tourism inflows - alongside strong policy support and export demand.

Dave Richards, managing partner of impact investor Capria Ventures, told DealStreetAsia, "Investor money that might have gone into Myanmar will not be going there. The countries around the region will benefit."

The U.S. company had planned to invest up to USD8mn in several countries in February last year - with a focus on Myanmar - but it postponed the plan and is set to make its first investment in Vietnam this year.

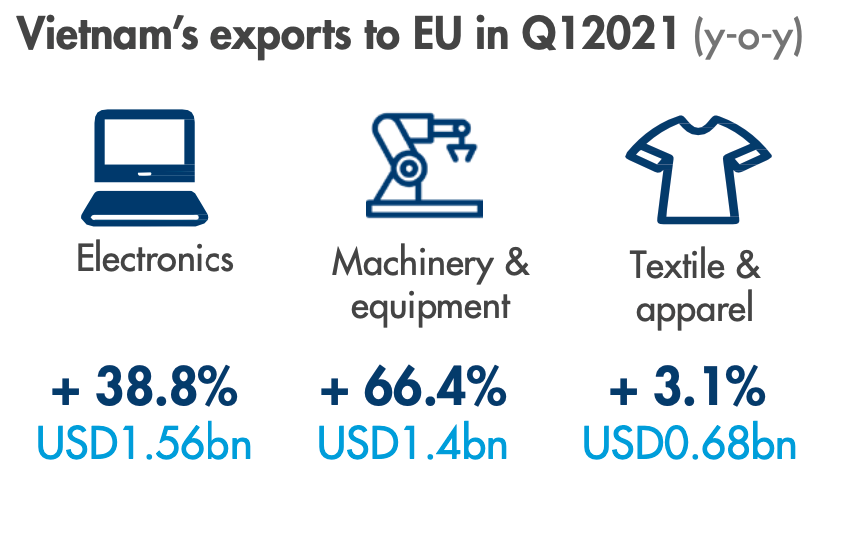

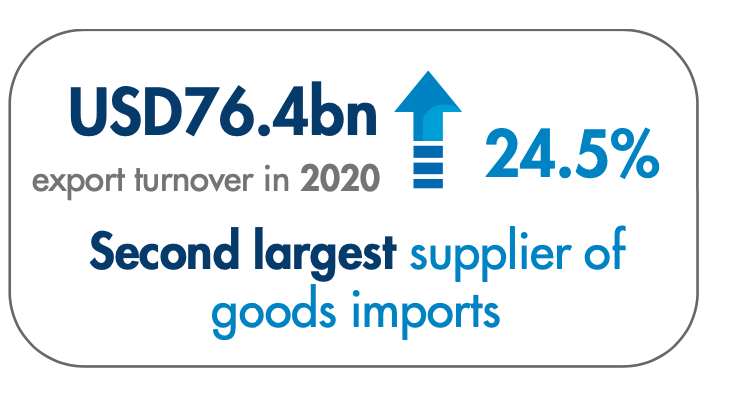

According to Vietnam’s General Statistics Office, Vietnam's exports to the EU reached USD9.6bn in Q1 2021 - an increase of 14.2% vs Q1 2020.

Vietnam’s main exports to the EU are telephone sets, electronic products, footwear, textiles & clothing, coffee, rice, seafood, and furniture.

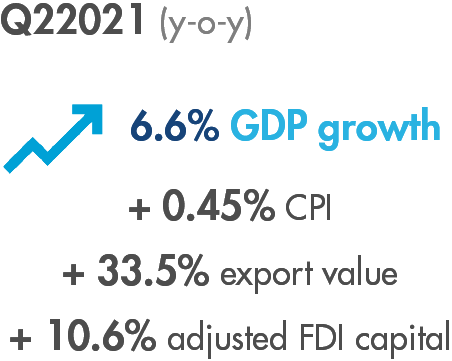

The Vietnamese economy is growing again on the back of a strong rise in exports, the Wall Street Journal reported.

Q1 2021 gross domestic product picked up 4.48% year-on-year as the recovery was driven by a surge in goods and services sold abroad, which rose almost 20% from last year’s figure. Notably, sales to the US are surging even faster with no sign of a slowdown on the horizon.

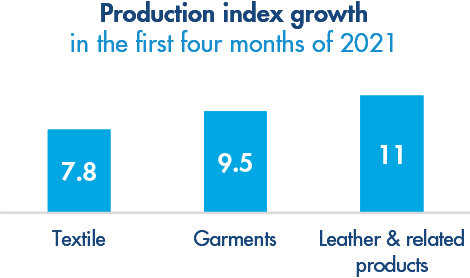

According to the latest report on trade and industrial manufacturing by Vietnam’s Ministry of Industry and Trade, the textile & garment, leather and footwear industries had USD15.9bn of exports in the first four months of 2021.

This is a positive sign as some of Vietnam's major export markets gradually recovered while Vietnamese companies have taken advantage of new free trade agreements.

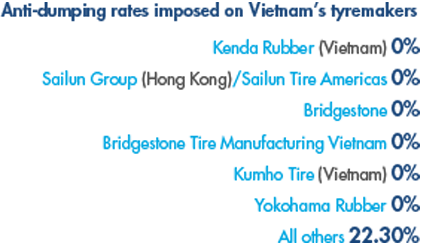

“A zero percent antidumping duty would help Vietnam’s major tire producers to continue exporting to the U.S.,” stated Vietnam’s Ministry of Industry and Trade.

“Vietnamese tires would gain considerable advantages against those from South Korea, Taiwan and Thailand that are subject to dumping rates from 13.25%-98.44% in the U.S. market,” noted the ministry.

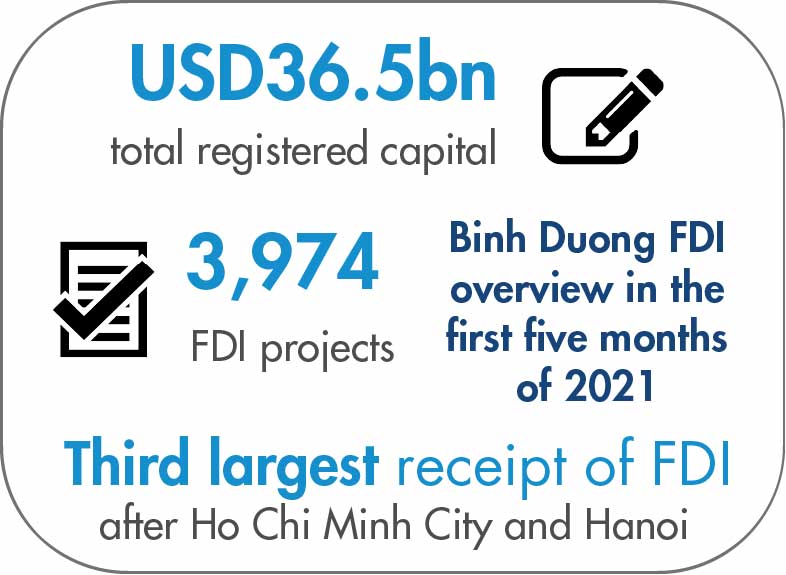

The five projects include two newly registered projects and three projects increasing capital with total newly registered and supplemented capital of USD974mn, the People Newspaper reported.

The five sub-projects include: (1) the Dien Chau-Bai Vot sub-section (between Nghe An and Ha Tinh provinces); (2) Nha Trang-Cam Lam (located in Khanh Hoa Province); (3) Cam Lam-Vinh Hao Highway (running through Khanh Hoa, Ninh Thuan and Binh Thuan provinces); (4) National Highway 45-Nghi Son and (5) Nghi Son-Dien Chau (running through Thanh Hoa and Nghe An provinces).

MANUFACTURING

Austria printed circuit board manufacturer AT&S has been studying several locations in Vietnam to build two factories worth EUR1.5bn (USD1.78bn).

There is a likelihood that the northern province of Thai Nguyen will be able to match the firm’s infrastructure requirements, AT&S Chief Operating Officer Ingolf Schroeder said.

On May 21, 2021, Binh Duong’s provincial administration handed over the certificate for Far Eastern Group’s latest investment of USD610mn.

Taiwanese companies in Vietnam are largely involved in the textile & garment, footwear and support industries. Typically, they prefer the Southern Key Economic Region thanks to its advantages pertaining to market access and support industries.

South Korea’s Kumho Tire plans to invest USD305mn to expand its plant in Vietnam.

"After considering our plans to increase exports to North America and potential U.S. anti-dumping duties we came to the conclusion that increasing the capacity of the Vietnamese plant would be the best solution," a Kumho executive said.

Taiwan's government approved a USD101mn increase in investment in Vietnam by Pegatron Corp, a major manufacturing partner of Apple, Microsoft and Sony.

The Taiwan Economy Ministry's investment commission said the investment in Pegatron's Vietnam subsidiary would be for the production and sales of computers & peripheral equipment, communication equipment and electronic components.

In Vietnam, American technology giant Apple recorded 21 suppliers - higher than the 14 in 2018. The figure is also higher than Thailand with 15 suppliers and India with nine suppliers, according to Nikkei Asia Review.

The growing number of suppliers in Vietnam is part of the tech giant's efforts to remove production lines from China, fueled by prolonged U.S.-China tensions.

Japan-based Foster Electric plans to launch a joint venture in Vietnam with China's Hengdian Group DMEGC Magnetics Co. to manufacture ferrite magnets, a key material for speakers. The plant will be established in An Phat 1 High-tech Industrial Park in the northern province of Hai Duong.

The company expects that stable local procurement of ferrite magnets will improve cost competitiveness and quality while reducing supply chain risks.

LEGAL UPDATES

We would like to inform you about legal updates from this quarter regarding tax, HR and labor issues.

TAX

-

1. Enterprise income tax incentives for projects manufacturing supporting industry products

According to Decree No. 57/2021/ND-CP, dated June 4, 2021, of the Government supplementing Point g, Clause 2, Article 20 of Decree No. 218/2013/ND-CP, enterprises that had projects manufacturing supporting industry products before January 1, 2015, but have not yet enjoyed enterprise income tax incentives for the income generated from such projects shall be entitled to enterprise income tax incentives under the conditions for projects manufacturing supporting industry products from the tax period during which they are granted the incentive certificate for manufacturing of supporting industry products by a competent agency.

HR & LABOR

-

3. Employees are exempted from paying health insurance premiums until January 2022

Accordingly, Vietnam Social Insurance has agreed to exempt health insurance premiums for employees who are temporarily suspending the performance of their labor contracts and those who take unpaid leave at units and enterprises that have suspended operations at the request of Government agencies to prevent and control COVID-19.

-

4. National database on insurance

The Government issued Decree No. 43/2021/ND-CP providing a national database for insurance on March 31, 2021. This decree took effect on June 1, 2021. Accordingly, the National Database on Insurance is a national database that archives information on social insurance, health insurance, unemployment insurance and information on health and social security recognized by competent agencies and ensures the insurance-related interests and obligations of citizens. Data extracted from Insurance National Database shall be valid as written certification.

BUSINESS ACTIVITY

-

5. New regulations on origin of goods in the UKVFTA Agreement

The Ministry of Industry and Trade issued Circular 02/2021/TT-BCT stipulating the rules of origin of goods in the free trade agreement between Vietnam and the United Kingdom (UKVFTA). If the shipment is worth less than EUR6,000, any exporter is allowed to self-certify origin (C/O). For shipments valued at over EUR6,000, the C/O mechanism issued by agencies and organizations authorized by the Ministry of Industry and Trade will be applied.