August 13, 2025

Trend & future insight

Navigating Trade Crosswinds: BW Industrial & Acclime Vietnam Release 2025 Manufacturing Report

August 14, 2025

Download the full report: here

Vietnam’s leading logistics and industrial real estate platform BW Industrial and the corporate services provider Acclime have jointly released the industry report “Manufacturing & Supply Chain in Vietnam: Navigating Through Trade Crosswinds 2025–2026”, a comprehensive study offering forward-looking data and insights.

The report arrives at a crucial moment. Lance Li, CEO of BW Industrial, stated: “What’s most exciting about Vietnam’s manufacturing potential today is the convergence of two forces: the acceleration of supply chain diversification and the increasing shift away from transshipment strategies. As tariffs reshape global trade routes, more Chinese-linked supply chains are moving directly to Vietnam over the next decade.”

Vietnam’s competitive edge

The country’s strong trade network is a key attraction. Vlad Savin, Partner at Acclime, highlighted that “Despite the latest challenges, Vietnam’s manufacturing remains a window of opportunity for investors. For example, FTAs provide Vietnam with preferential trade access to markets encompassing over 3.5 billion people, accounting for nearly half of the global population.”

Global manufacturers are already making strategic moves. For Gaizka Garcia Ariño, General Director of Teclon, when evaluating expansion options in Southeast Asia, Vietnam stood out among strong contenders like Thailand and Malaysia. The country offered a straightforward, business-friendly environment and access to reliable outsourcing partners for critical processes such as heat treatment and zinc plating — both essential to maintaining product quality and compliance. Positive references from our network in China further reinforced our confidence in Vietnam as the ideal location. “Ultimately, this decision was grounded in strategic alignment, trusted relationships, and long-term potential,” he added.

Anshon Li, General Director of Chervon, emphasized that the decision goes beyond tariffs. Manufacturers are unlikely to relocate operations to other emerging markets based solely on marginal tariff advantages, as regional supply chain resources, cost considerations, and human resource advantages must also be evaluated – particularly when accounting for switching costs, regulatory complexities, and operational risks.

“The future of global manufacturing hinges not merely on finding the lowest-cost production location, but on identifying the optimal base for comprehensive operational development. For Chervon, entering Vietnam transcended a routine business decision; it represented a strategic long-term investment,” he emphasised.

Key insights from the report

The Manufacturing & Supply Chain in Vietnam 2025–2026 report spans nine chapters, offering practical intelligence for manufacturers and investors. Some of the main takeaways include:

- Tapping into Vietnam’s manufacturing ecosystem. The Next Growth Frontier. Vietnam today has emerged as a critical manufacturing and export hub in global supply chains, echoing China’s experience following WTO entry. Like China at that time, Vietnam leverages competitive labor costs and favorable trade access to attract export-oriented FDI, particularly in electronics and consumer goods. In 2024, Vietnam’s electronics exports reached record highs with US$126.5 billion, underscoring its growing expertise in these fields. Relating to FDI-led exports, over 70% of Vietnam’s export value comes from foreign-invested firms, mirroring China’s initial foreign-led model.

- Vietnam’s infrastructure and logistics hub development. Urbanization rate: 40–42% (comparable to China in 2000–2003). Vietnam is at the beginning of a multi-decade urban-industrial expansion, akin to China’s 1995-2005 infrastructure phase.

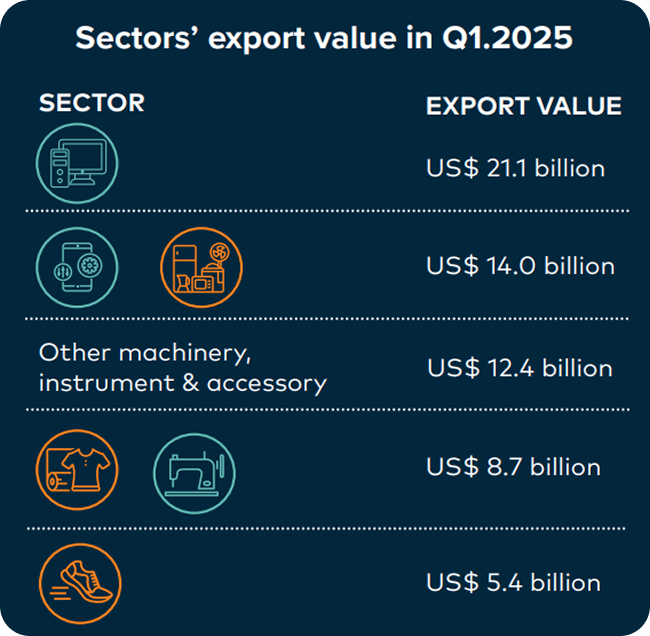

Riding the high-tech wave. Technology-driven exports, particularly electronics and machinery, have taken the lead, growing at a CAGR of 14.1% between 2016 and 2023. However, innovation gap is observed. Vietnam faces the same inflection point China encountered in the mid-2000s: transitioning from technology adopter to innovator. The government’s Industry 4.0 initiatives and R&D incentives signal awareness of this challenge, but execution remains far behind China’s innovation capacity.

Financial System and Capital Markets Vietnam’s financial system is at an early reform stage, much like China’s in the early 2005—dominated by state banks, with emerging capital markets.

Factory of the future – sustainable and automated. RBF and RBW models are gaining significant traction due to their faster time-to-market (as short as 6–7 months), competitive rental costs (approximately USD 5 per sqm per month), and flexible lease terms.

Supply chain competitiveness amid tariff disruptions. Compared to India, which currently face average US import tariffs of around 50%, Vietnam’s reduced rate of 20% gives it a significant pricing advantage.

Regulatory insights for manufacturers, licensing, incentives, and trade compliance in Vietnam. Vietnam ranks highest among the featured emerging markets for “Ease of Doing Business,” with 31% of investors citing it as a key reason for investment, outperforming regional peers such as Malaysia (25%) and Thailand (24%).

Strategic Outlook: Vietnam offers investors exposure to early-stage growth dynamics similar to China’s 2000s era, but with a faster, more open, and more externally oriented framework. Vietnam’s success will depend on sustaining macroeconomic stability, deepening human capital, and advancing domestic innovation over the coming decade.