Trends & Future Insights

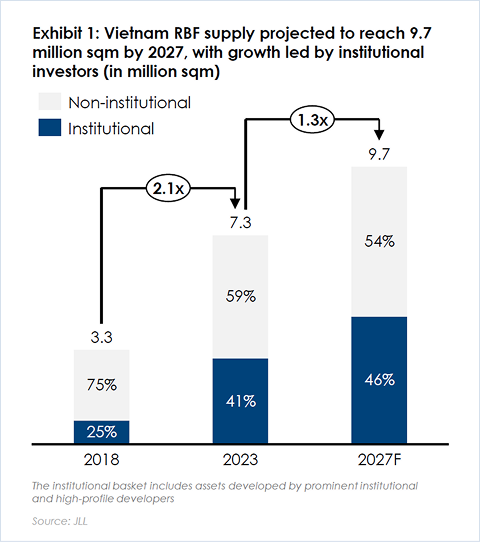

Vietnam’s industrial real estate sector continues to play a pivotal role in the global supply chain, driven by FDI, expanding manufacturing capabilities, and innovative market solutions. The Ready-Built Factory (RBF) market has undergone a significant transformation and is positioned for sustained growth.

Tenant Base Dynamics

Vietnam’s tenant base has undergone a significant evolution, reflecting the country’s growing prominence in global supply chains. Chinese speaking regions, encompassing Mainland China, Hong Kong, Taiwan, and Singapore, has been a key driver of demand, accounting for approximately 60% of leasing inquiries. This highlights Vietnam’s appeal to tenants seeking proximity to their supply chains and alignment with Eastern business practices.

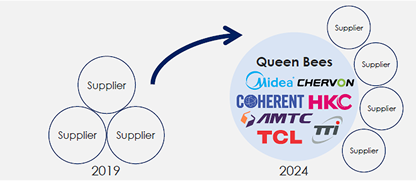

The rise of “Queen Bee” tenants – key players within their industries – has further shaped the market, with these industry leaders often leasing larger areas to serve as hubs for their supply chains. This shift reflects the increasing scale and sophistication of operations relocating to Vietnam.

Exhibit 15: The step changes in BW tenant base reflect the rapid evolution of the RBF market

Nearly doubling of manufacturing classifications reflects industry expansion (%)

A shift of RBF tenants base - from supply-chains to Queen Bees

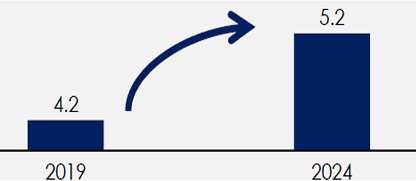

Rising average RBF leased area per tenant reflects industry scaling and tenant evolution

(k sqm)

Geographically, the North and South continue to dominate as the most favorable locations for tenants. The North, led by Hanoi, Bac Ninh, and Hai Phong, attracts advanced manufacturing operations due to its proximity to China and well-developed infrastructure. Meanwhile, the South, anchored by Ho Chi Minh City, Binh Duong, and Dong Nai, remains a hub for diverse industries, benefiting from its established business ecosystem and strong logistics network.

Tenants leasing RBF facilities also benefit from expedited timelines, with operations typically commencing within 6-7 months of project initiation. This efficiency, combined with Vietnam’s strategic location and growing industrial capabilities, has solidified its position as a top destination for manufacturing investment.

Emerging Trends and Future Growth

Outlook and Conclusion

Vietnam’s industrial real estate sector is well-positioned for sustained expansion, supported by its innovative RBF solutions, diverse tenant base, and commitment to advancing global manufacturing standards. With trends like multi-story facilities and renewable energy solutions on the horizon, Vietnam continues to solidify its role as a leading destination for global investors and manufacturers, adapting to the demands of an ever-changing industrial landscape.