사업 환경

Exploring Vietnam’s Potential as an Electrical Equipment (EE) Hub

7월 1, 2024

Vietnam has recently emerged as a dynamic player in the electrical equipment (EE) manufacturing industry. The Southeast Asian nation has swiftly transformed into a preferred destination for multinational corporations seeking cost-effective and efficient manufacturing solutions.

Investors from East and Southeast Asia, especially China and South Korea, consistently dominate among the foreign-invested projects in electrical equipment manufacturing. Until 2023, there have been around 2,000 companies operating in the sector, employing over 251,000 workers.

Investment projects primarily focus on processing and assembly, followed by component manufacturing. Projects in supporting industries and the repair of electrical equipment are limited and relatively modest in scale.

The Northern region is a key hub for manufacturing, particularly in battery and accumulator production, as well as wire and cable manufacturing, with a concentration in Hai Phong, Bac Giang, and Bac Ninh. Meanwhile, in the Southern region, there’s a focus on projects related to consumer electrical goods, motors, generators, and lighting equipment.

Strategic Location

Vietnam’s strategic geographical location contributes significantly to its appeal as an EE manufacturing hub. Positioned in close proximity to China and at the heart of the Asia-Pacific, one of the world’s major EE manufacturing hubs, Vietnam gains a distinct advantage in terms of logistical cost and integration within the global value chain in the electrical equipment sector.

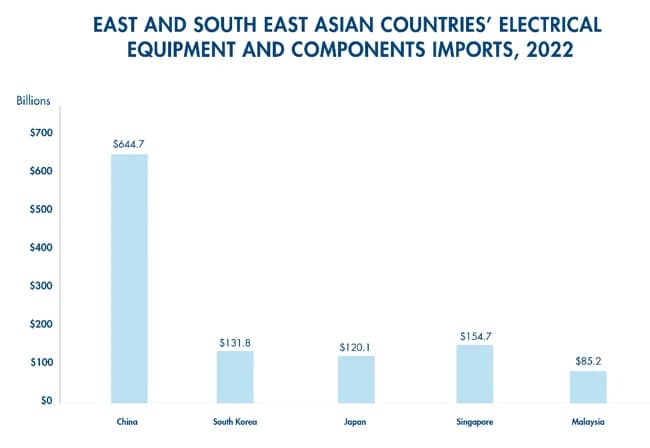

These neighboring countries not only serve as potential end-user markets for electrical products but also represent significant import markets for parts and components. For instance, in 2022, China alone imported US$664.7 billion of electrical equipment and components. Other notable countries in the region, such as Singapore, South Korea, Malaysia, and Japan, also have substantial requirements for electrical equipment and components, further highlighting Vietnam’s strategic importance in the global EE manufacturing landscape.

Source: UN Comtrade

Additionally, its strategic location, especially logistical advantages from Ho Chi Minh City to Southeast Asian markets, enables EE factories in Vietnam to achieve significant savings on logistics costs. The International Energy Agency (IEA) predicts that Southeast Asia will require approximately USD1.2 trillion in investment by 2040 to modernize and expand its grid. Vietnam-based factories stand to save 15-20% in costs compared to production and exports from China, particularly for bulkier electrical equipment like big power substations and capacitors weighing over 100 tons.

Opportunities in supporting segments

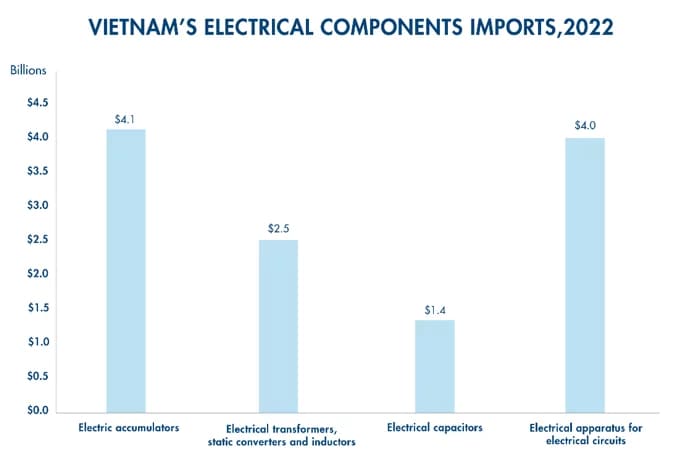

Despite having a thriving EE manufacturing industry, Vietnam continues to rely heavily on imports for various electrical parts and components. Notably, in 2022, Vietnam’s imports of accumulators accounted for US$4.1 billion, while apparatus imports amounted to US$4.0 billion. This reliance is primarily due to the absence of supporting companies for the country’s electrical equipment industries, making it an attractive prospect for both local and international manufacturers in the EE supporting segment.

Source: UN Comtrade

Furthermore, Vietnam possesses a significant wealth of minerals. It hosts some of the world’s largest reserves of valuable resources, such as bauxites, rare earths, and economically viable deposits of oil, gold, copper, tin, and various other minerals essential for the manufacturing of electrical components. Notably, estimations by the US Geological Survey indicate that Vietnam’s rare earth reserves amount to approximately 22 million tons, ranking at the 2nd position globally. Additionally, Vietnam holds the world’s leading reserves of bauxite ore, a crucial input for aluminum production, with reserves totaling 3.7 billion tons, securing the 3rd position worldwide. This natural abundance of input materials not only strengthens Vietnam’s strategic standing in the EE supporting industries but also guarantees a reliable and secure supply chain for investors.

Government incentives in response to growing demand

Electrical equipment is a key sector receiving significant attention and support from the government. According to Mordor Intelligence, Vietnam’s energy demand is expected to increase by 10% annually over the next 5 years, doubling the required electricity capacity. Therefore, under the National Plan to Develop EE Manufacturing Industry until 2025, the government has set an ambitious target to fulfill 100% of national demand of complete electric equipment sets for transmission lines and transformer stations by 2025.

This domestic demand surge not only creates opportunities for local manufacturers but also beckons international players to invest in Vietnam’s burgeoning electrical equipment market.

However, despite this promising scenario, challenges persist in Vietnam’s EE industry. The current focus leans toward low-value products, while there’s a notable gap in the production of modern, high-value electrical equipment. In response to this, the Vietnamese government has introduced incentives to attract foreign direct investment (FDI) in EE production lines, emphasizing large power substations, distribution and transmission equipment, pressure equipment, and other electrical components.