商业环境

Crafting Success: Unveiling 3 Reasons Vietnam Shines As A Promising Computer And Consumer Electronics (Cce) Manufacturing Destination

1 7 月, 2024

Vietnam has emerged as a highly attractive destination for CCE manufacturing, drawing the attention of global industry leaders when relocating production out of China. Three key reasons that make Vietnam an increasingly attractive choice for CCE manufacturing have been its strategic location, the presence of industry queen-bees, and a workforce that combines skill with affordability.

Prime location and connectivity

Vietnam’s strategic position, nestled amidst major consumer markets, is pivotal for establishing the country as a hub for Consumer Electronics (CCE) manufacturing. Its close proximity to China, home to over 1 billion consumers and a thriving electronics market projected to reach US$218.6 billion in 2024, makes Vietnam an enticing prospect for investors looking to relocate their manufacturing operations.

Further, situated at the heart of Southeast Asia, Vietnam acts as a vital link to the ASEAN region, which also experiences a surge in demand for electronics products. Statista predicts that the revenue in Southeast Asia’s consumer electronics market will hit US$55.8 billion in 2024, with a Compound Annual Growth Rate (CAGR) of 1.45% over the next five years.

Vietnam’s strategic location not only translates into savings on logistical costs but also slashes transportation time for investors. For example, the average transportation time from Hai Phong Port to Shenzhen Port is a mere 3 days, compared to 3 to 6 days for other ASEAN countries.

Additionally, Vietnam boasts significant connectivity and proximity not only to neighboring countries but also to major global export markets such as East Asia, Europe, and North America. Key container ports like Cat Lai Port, Cai Mep – Thi Vai Port in the Southern hub, and Hai Phong Port in the Northern hub offer direct transportation routes to Europe and North America, ensuring a dependable and direct link for global trade. This advantageous location, coupled with robust connectivity, solidifies Vietnam’s position as a pivotal player in the global CCE manufacturing landscape.

Queen-bees of the industry establishing a thriving ecosystem

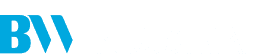

Vietnam has successfully attracted major leaders in the CCE industry, such as Samsung, Apple, LG, Canon, Toshiba, and more. According to the Ministry of Industry and Trade, Apple has completed the transfer of 11 audio-visual equipment factories to Vietnam, while Samsung has shifted its entire smartphone production line to both Vietnam and India. Currently, a substantial 60% of Samsung’s smartphones sold worldwide are manufactured in Vietnam.

The relocation of these industry giants has fostered a thriving ecosystem and attracted investment of satellite manufacturers. For example, notable Tier-1 suppliers of these CCE brands have invested billions of dollars to establish manufacturing facilities in Vietnam. These include Goertek’s US$1.1 billion investment in Bac Ninh and Nghe An provinces to manufacture acoustic precision components, Meiko’s US$500 million investment in Hanoi for PCB assembly, Hansol Electronics with a US$100 million investment in Dong Nai to produce smartphone components, among others.

Further, Samsung has conducted a series of support program to promote the development of Vietnam’s electronics industry. Since 2015, Samsung’s experts have supported nearly 400 Vietnamese companies to enhance their competitive capabilities, improve product quality and conducted training programs for hundreds of local experts.

With the combined expertise and best practices of these industry leaders, Vietnam’s CCE manufacturing sector is propelled to new heights. This dynamic environment encourages innovation, technological advancements, and sets high standards for product quality and efficiency.

Abundant labor force at an affordable cost

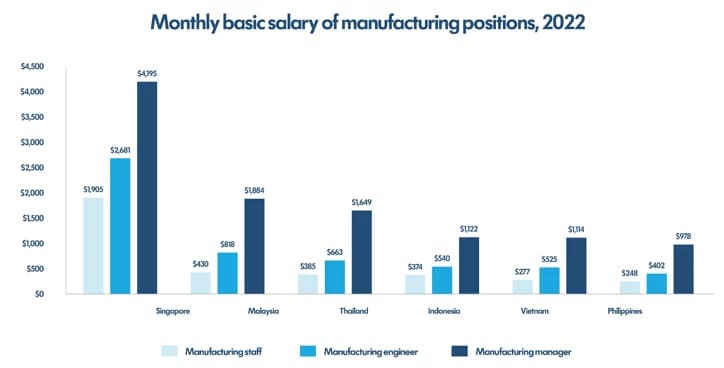

Investing in Vietnam provides a significant advantage due to its skilled and cost-effective labor force, making it an appealing choice for labor-intensive industries like consumer electronics. As of 2023, Vietnam’s population reached 100.3 million, with 62.2% falling within the working age. Meanwhile, as indicated by the 2022 Survey on Business Conditions of Japanese Companies Operating Overseas by JETRO, Vietnam’s labor expenses, despite experiencing an increase, remain notably lower than those in fellow ASEAN manufacturing centers like Singapore, Indonesia, Thailand, and Malaysia. The average monthly basic wage for a production worker in Vietnam stands at just US$293 as of 2023.

Source: JETRO

In January 2023, Prime Minister approval of Resolution No. 06/NQ-CP marked a commitment to labor market development from 2021 to 2025. The resolution aims for an annual labor productivity growth rate of 6.5% or higher, 30% of workers with degrees and certificates, and a general unemployment rate below 3%. This underscores Vietnam’s dedication to fostering a skilled and productive workforce for investors.